Section 179 is a tax incentive for manufacturers to get a write off on purchases of equipment. The IRS tax code Section 179 deduction is a way to reduce the total cost of new equipment and machinery by enabling the buyer to claim full depreciation in year one. Normally, that depreciation (referred to as “bonus depreciation by the IRS) would be parceled out annually over the time the purchase is financed.

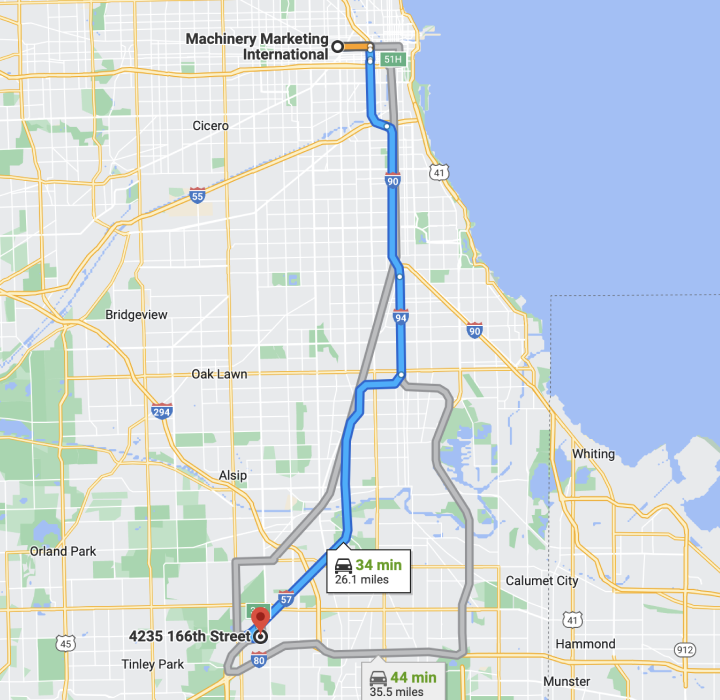

Machinery Marketing International

Corporate Headquarters

1626 West Lake Street 2nd Floor

Chicago, IL 60612

Receive information on exclusive deals, special pricing, new inventory notifications and alerts for the machines you need.

4235 166th street Oak Forest, IL 60452