YOU DID THE WORK, NOW SECURE YOUR LEGACY

You’ve built a business defined by precision, a strong reputation, and loyal customers. Instead of retiring and walking away, consider maximizing the full value of your work by selling your company as a thriving, ongoing operation.

Process

ENGAGEMENT

MMI is engaged to represent the manufacturing business, defining objectives and transaction goals in collaboration with ownership.

VALUATION & POSITIONING

Our team develops a detailed valuation and market analysis, combining financial insight and industry data to position the business effectively for qualified buyers.

BUYER QUALIFICATION

Buyers sign NDAs and gain access to confidential materials, ensuring transparency while protecting seller interests.

BIDDING, CLOSING & TRANSITION

Qualified buyers submit bids, and MMI works with the seller to select the top offer. MMI then manages due diligence and closing, typically completing the process within about 180 days.

Looking to sell your business?

Selling a business is more than a transaction, it’s a transition. MMI prepares you for every step, from understanding valuation and strengthening your financial story to identifying the right buyers and negotiating terms. Whether you’re planning a sale soon or simply exploring your options, we’ll help you position your business for the strongest outcome.

Share a few details about your goals, and our team will connect with you to discuss your best path forward.

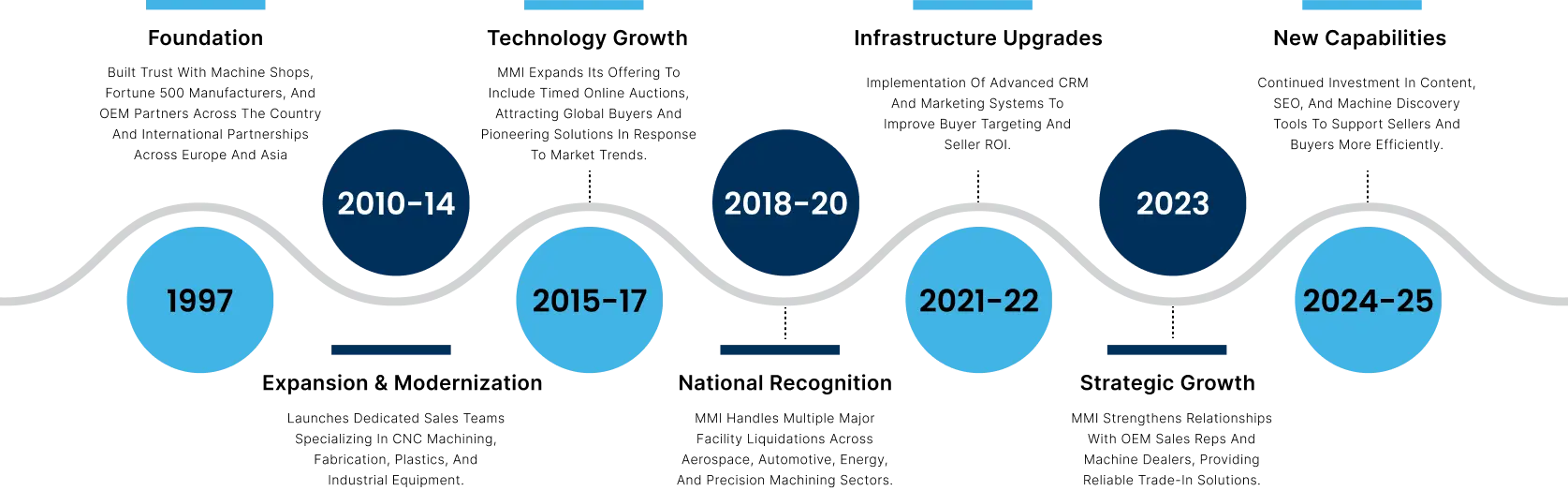

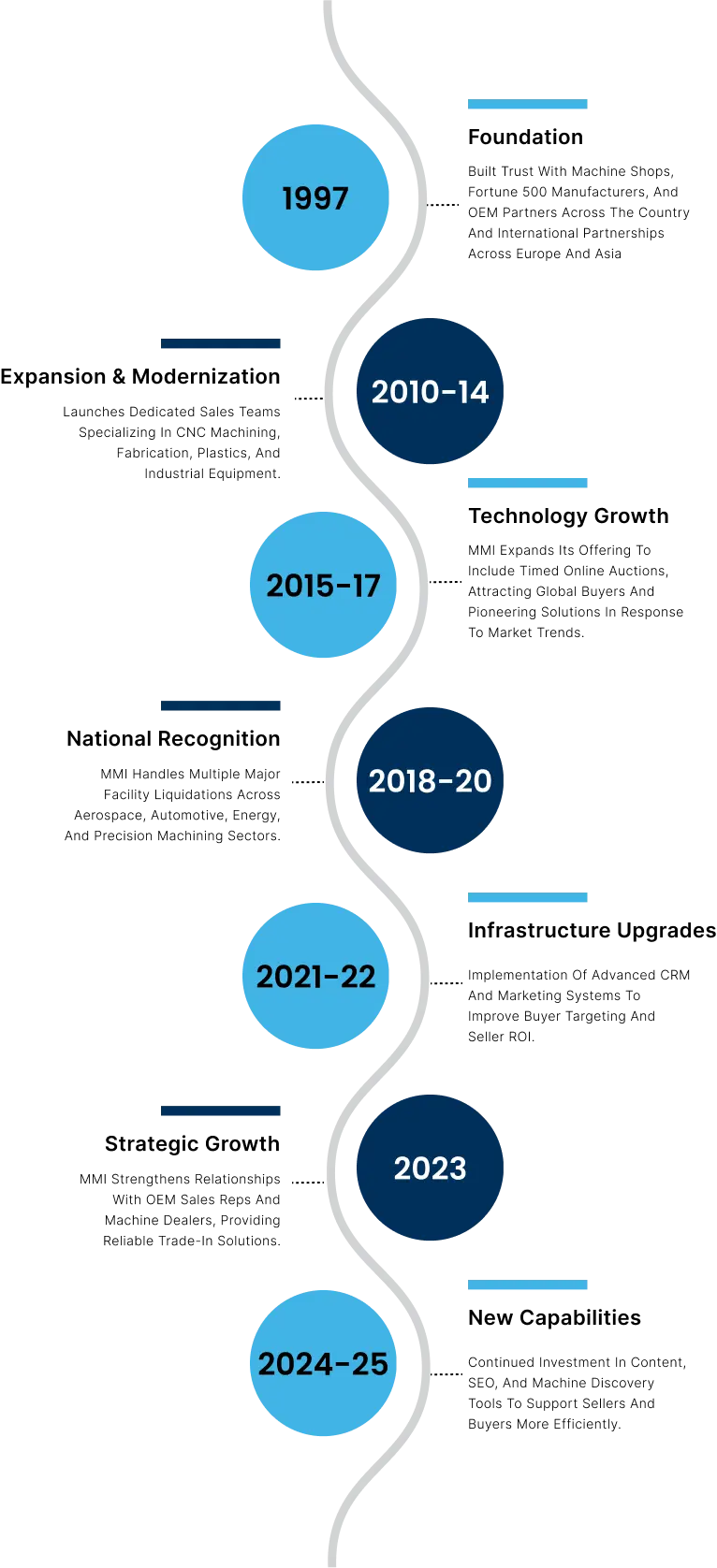

MMI Timeline

The Team

Guidance You Can Trust

Robert Person

President, Asset Management & Recovery

Why Partner With MMI Business Advisory

Machinery Expertise You Can’t Replicate

At MMI Business Advisory, we don’t just read financials, we understand machines, production floors, and the realities of running a metalworking operation. With almost 30 years inside this industry and tens of thousands of CNC and fabrication assets sold, valued, and moved, our expertise is built on real hands-on experience. While traditional advisory firms rely on spreadsheets alone, we bring true industrial intelligence backed by proprietary data, decades of market insight, and a nationwide network of machine buyers, sellers, riggers, and operators. Owners trust us because we speak the language of manufacturing and deliver transitions that are not only financially sound, but operationally smart and grounded in how real shops run.

Our Footprint: A Network Built on Owners

Most advisory firms depend on a small circle of private equity and venture groups, but MMI Business Advisory operates on a completely different level. Our reach is built on one of the largest networks of manufacturing owners, operators, and industry buyers in North America, expanded from a 500,000+ end-user database and decades of machinery relationships. This footprint lets us do what traditional firms can’t: connect owners to owners. We pair businesses with buyers who understand the craft, respect the workforce, and value the legacy behind the company, not just the EBITDA multiple. For sellers, that means your identity stays intact, your employees stay supported, and your mission continues under leadership that shares your values. Our network gives you more options, more alignment, and more control over your future, all while achieving strong valuations and successful outcomes.Our Focus: One Industry, One Mission, Nearly 30 Years Strong

MMI isn’t a generalist advisory firm, we have one focus: Metalworking and Manufacturing. That specialization gives us a level of clarity, depth, and credibility broad advisory groups simply can’t match. For more than three decades, we’ve built MMI around deep relationships with OEMs, job shops, aerospace and defense suppliers, and heavy industry partners. Our market intelligence comes from over 17,640 machine transactions, supported by a team of machinery experts, valuation professionals, and deal specialists who understand this sector from the inside out. With a national footprint, a 40,000 sq. ft. facility, and a network spanning 10,000+ dealers and 500,000+ end users, we guide transitions with precision and confidence. We are metalworking people, and have been for almost 30 years, and every deal we execute is backed by the relationships, knowledge, and trust built across decades in this industry.

Download Our Business Advisory Overview

A detailed overview of how MMI helps buyers, sellers, and investors in the machinery industry.

Contact Information

FAQ

MMI Business Advisory manages the full transaction process, including marketing materials, business valuation, identifying qualified acquirers, preparing legal documents, handling confidentiality agreements, and coordinating due diligence.

MMI Business Advisory handles valuation, prepares marketing materials, identifies acquirers, manages confidentiality, qualifies buyers, coordinates bidding, and oversees due diligence and closing.

A standard sale process takes approximately 6 months from engagement to closing.

Yes. We provide access to our proprietary investor database, strategic buyers, family offices, private equity groups, and additional vetted acquirers.

Confidentiality is safeguarded through a secure investor portal, ShareFile/virtual data room, and third-party AI-driven systems to control and monitor access.

Your transaction will be led by:

-

Robert Person, President & Head of Asset Management

-

Paul Zimmer, CEO

Meetings may be held in-person or via Teams/Zoom.

MMI Business Advisory presents all offers and helps the seller assess deal structure, non-refundable vs. refundable deposits, buyer qualifications, and transaction risk.

Buyers usually look for key legal, financial, operational, customer, and HR details. This includes corporate documents, financial statements, tax returns, machinery and equipment lists, production processes, major customers, employee information, and any compliance or safety records. They may also ask strategic questions about competitive advantages and growth opportunities, and often conduct a site visit to review equipment, workflow, and overall operations.

We use a ShareFile virtual data room to manage all documents provided to buyers. This system offers encrypted storage, controlled access, and full visibility into who has viewed or downloaded materials, ensuring sensitive information remains protected at every stage of the process.

ES

ES